Bitwise Terminal 2.3.0 now supports relative price notation, which further simplifies order creation when you intend to specify a price relative to the highest bid or the lowest ask.

Suppose you’re trading XBTUSD. The best bid and ask are 9359.5 and 9360 respectively.

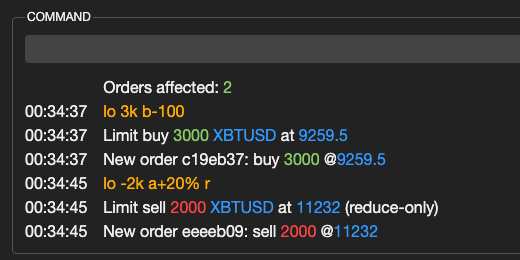

To buy at $100 below the bid, you may enter b-100 as the limit price instead of the more explicit 9259.5.

Similarly, to set a price 20% above the ask, a+20% would do the math for you: 9360 × (1 + 20%) = 11232.

Using relative price notation in CLI

Relative price notation is not limited to the lo (limit order) command as shown above.

You may use it in smo (stop orders) or so (scaled orders) as well.

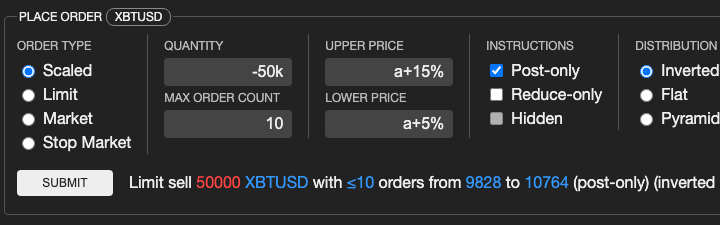

Any price field in the GUI also accepts the relative notation.

Using relative price notation in GUI

A few more examples:

a— the lowest ask price without changesa+0.5— the lowest ask price plus 0.5a+.5— same as above, only one keystroke shorter9360-33.3%— 6243 (6243.12 rounded to the nearest tick size, depending on the instrument being traded)

Caveat: in a turbulent market, the bid and ask snapshots used in relative price calculation may, for split of a second, lag behind the most up-to-date bid/ask in the orderbook.